India’s Battery Waste Management Rules 2022: What They Mean for OEMs and Consumers

>

>

India’s transition from a “use and dump” culture to a circular economy is gaining momentum, and batteries are at the center of this shift. The Battery Waste Management Rules, 2022 are a cornerstone policy that not only defines how used batteries are collected and recycled but also how valuable resources are brought back into the economy.

For India, where lithium-ion batteries (LIBs) are powering the EV revolution, energy storage, and digital electronics, this framework goes beyond waste management—it directly connects to critical minerals security and the country’s path to Net Zero 2070.

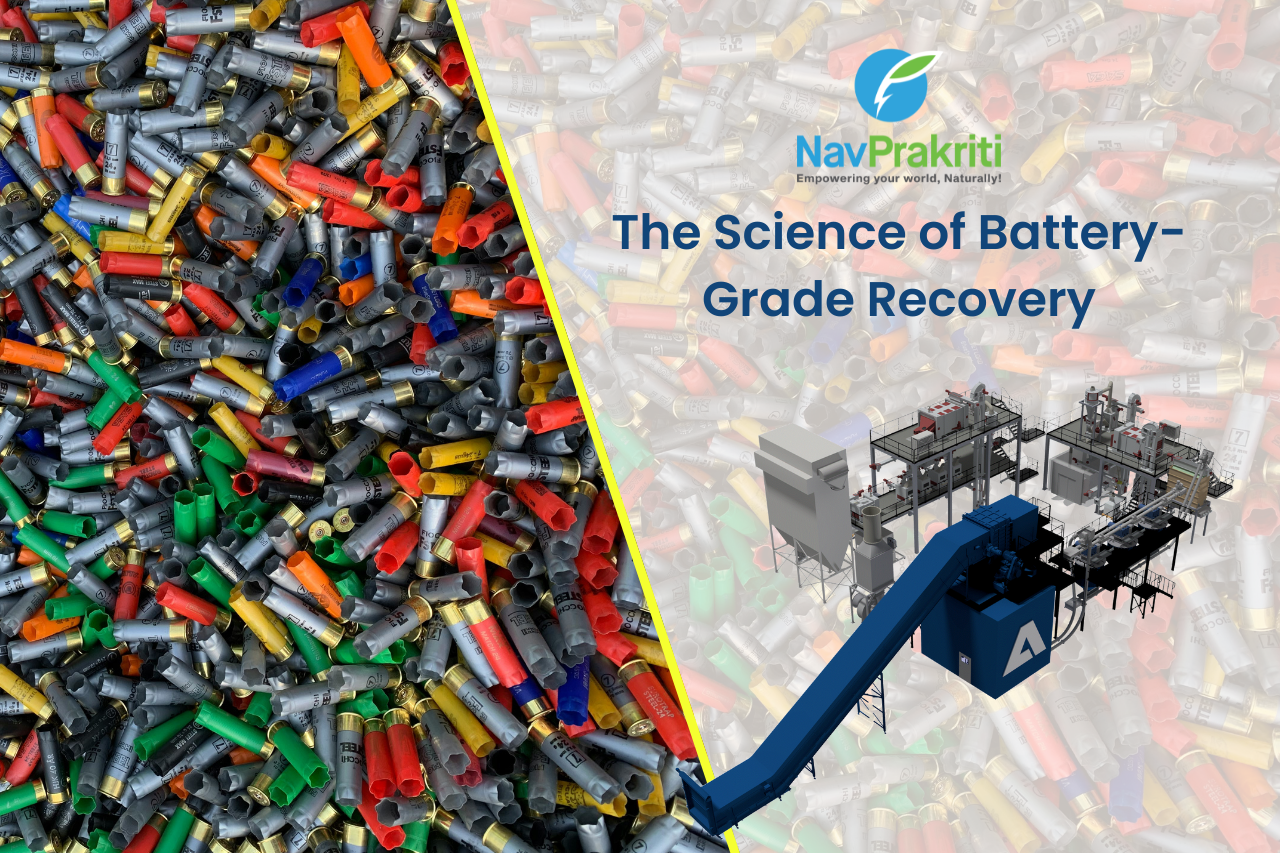

At Nav Prakriti, we’ve been building solutions for this future from the ground up. As the first company in East India to set up large-scale battery recycling operations, with an annual capacity of 24,000 tons, our mission is simple: to recover metals, reduce import dependence, and close the loop through advanced LIB recycling technologies.

Why these rules matter

- ➤ Extended Producer Responsibility (EPR) is now the law – Every OEM, importer, or seller must ensure batteries are collected and recycled responsibly.

- ➤ LIB recycling outcomes are measurable – Recyclers must recover 70% of materials in 2024–25, 80% in 2025–26, and 90% from 2026 onwards.

- ➤ Recycled content is compulsory – From FY 2027–28, a portion of every new battery must use recycled metals, scaling up to 20% by 2030–31.

- ➤ Critical minerals at stake – Nickel, lithium, and cobalt are finite. Recycling secures these minerals domestically and reduces import reliance.

- ➤ Net Zero 2070 connection – Effective battery waste management reduces emissions from mining and raw material processing, aligning with India’s climate commitments.

Who is affected?

These rules cover all battery categories EV, portable, automotive, and industrial. OEMs must register on CPCB’s EPR portal, report their battery volumes, and meet recycling/refurbishment obligations. Consumers also have a role to play: used batteries cannot be thrown in household waste and must be handed over to registered collection centers or LIB recyclers.

This ensures accountability across the chain from EV makers to everyday households.

What OEMs need to do

For OEMs, the compliance roadmap is detailed and time-bound. Producers must file their EPR plans, ensure collection of past-year batteries, and partner exclusively with registered recyclers or refurbishers. Recovery efficiency is tightly monitored, with LIB recycling targets rising sharply in the next three years. From FY 2027–28, OEMs must also use recycled content in new batteries, meaning advance planning for critical minerals supply is non-negotiable.

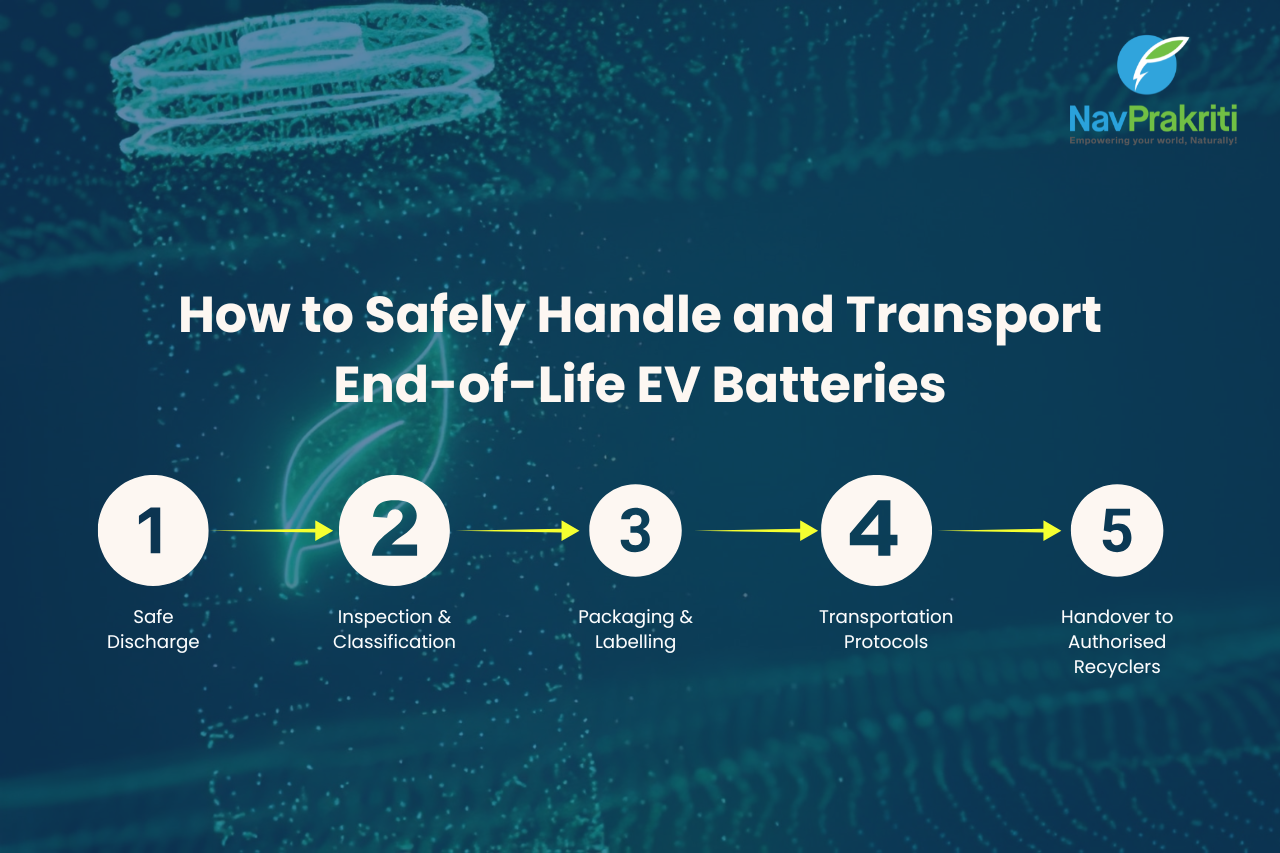

Failure to comply triggers Environmental Compensation penalties, while correct labeling, safe transport, and adherence to BIS standards are also mandatory.

What consumers should know

Consumers may not realize it yet, but their participation is crucial for this system to work. Used batteries must be returned through authorized channels, not dumped in landfills or household bins. Soon, consumers will see more deposit-refund models, take-back schemes, and dealer-led collection drives, especially for EV batteries.

👉 Every battery returned is a step towards resource security and a cleaner, net zero future.

Compliance roadmap for OEMs

OEMs should start by mapping historic and current LIB sales to anticipate future obligations. Building reverse logistics for safe collection and transport is next, followed by sourcing partnerships with registered recyclers. Long-term contracts for recycled lithium, nickel, and cobalt will become a competitive advantage as recycled content mandates approach.

Risk management is equally vital: OEMs must monitor obligations monthly, purchase EPR credits if necessary, and avoid long-term Environmental Compensation penalties.

Challenges in execution

Execution is not without challenges. Many OEMs still treat EPR as an annual compliance box to tick rather than a continuous responsibility. Partnering with unregistered recyclers, or even small missteps like incorrect labeling, can create compliance gaps. The reality is that battery waste management is both strategic and operational, requiring careful attention from boardrooms to shop floors.

The bigger picture

The BWM Rules 2022 mark India’s entry into a circular battery economy one where metals are recovered, reused, and kept in circulation. With EV adoption surging, so will battery waste volumes. Having the right LIB recycling ecosystem is not just about compliance—it’s about securing critical minerals and building resilience in India’s clean energy future.

This policy is also directly tied to India’s Net Zero 2070 goals. Recycling reduces mining-related emissions and ensures the country doesn’t swap one dependency (oil) for another (critical minerals).

How Nav Prakriti drives this change

At Nav Prakriti, we stand at the intersection of compliance, innovation, and sustainability. As East India’s first battery recycler with 24,000 tons annual capacity, we are committed to:

- ➤ Helping OEMs meet their EPR obligations with confidence.

- ➤ Designing reverse logistics and safe collection frameworks.

- ➤ Recovering critical minerals like lithium, nickel, and cobalt through advanced LIB recycling.

- ➤ Supporting India’s journey to a circular economy and Net Zero 2070.

Our role is not just about recycling batteries—it’s about building India’s battery future.

👉 The Battery Waste Management Rules 2022 are not just a regulation—they are a roadmap to India’s energy independence. For OEMs, recyclers, and consumers alike, how batteries are handled today will decide how sustainable tomorrow looks.

.png)